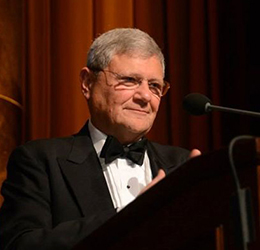

March 25th, 2017- Columbia Business School/Greater China Society

10th CHINA BUSINESS CONFERENCE

The China Business Conference (“CBC” or “Conference”), sponsored by the Columbia Business School in New York City, is one of the largest China-related business conferences organized by graduate-level business schools worldwide. CBC was established in 2008 with a vision to enhance participants’ understanding of China’s rapidly evolving business and economic environment, as well as to provoke constructive dialogs on key opportunities and challenges associated with doing business with China.

In March 2017, the Conference will focus on deriving meaningful predictions from reading the tell-tale signs of China’s current state of economic affairs, by featuring stimulating keynote speeches and panel discussions which span the spectrum of relevant industries including finance, cross-border commerce, real estate, tech, media and many more.

Get Ticket